Offer up to €3,235 net in additional purchasing power.

Save compared to an equivalent salary. Meal vouchers are 100% tax-deductible and exempt from social security charges.

Save compared to an equivalent salary. Meal vouchers are 100% tax-deductible and exempt from social security charges.

Self-employed ? Automate in 1 click. Working for a large company ? We connect to your payroll management tool.

At no extra charge.

Simple, transparent pricing.

You know what you're paying. Change the value of your shares ? Up fees don't change.

Packed with features

for your employees

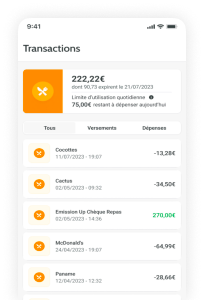

Your balance, recent transactions and cheque expiry date.

Available via the app or the website.

Even online. Even on delivery platforms.

1

Order cards and reload them in your customer area. You can automate the ordering process.

2

Cards are delivered within 10 working days to your employees’ homes or offices.

3

Your employees activate their card as soon as they receive it… and off you go !

As an employer, how can I deduct meal vouchers in my accounts ?

Meal vouchers are not taken into consideration when determining contributory income, i.e. there are no social security contributions to be paid by either the employer or the employee. Meal vouchers are fully deductible as an operating expense.

Tax exemption also remains conditional on the employer not having a company canteen.

Can I use meal vouchers abroad ?

The Up Luxembourg card can only be used in Luxembourg. Each country has its own legislation on extra-legal benefits. The granting of the Up Luxembourg card is subject to Luxembourg legislation.

How many meal vouchers can be distributed per employee ?

The number of meal vouchers awarded to an employee remains linked to the number of days actually worked. In practice, many employers allocate a fixed number of vouchers per month (generally 18 vouchers per month, 12 times a year, or 20 vouchers per month, 11 times a year).

In practice, and for reasons of administrative simplification, it has been agreed to allocate a fixed number of vouchers per month and per person, according to the following calculation:

52 weeks x 5 working days

= 260 working days

- 26 vacation days

- 11 public holidays

- 5 flat-rate days

= 218 luncheon vouchers per year

or 18 luncheon vouchers per month